By Kent R. Kroeger (Source: NuQum.com, August 9, 2022)

From elementary to high school, I was a short and skinny kid who was frequently subjected to various forms of socially acceptable peer group torture, the most common of which was the noogie headlock.

A guy wraps his arms around your neck from behind, bends you over and starts grinding his index finger’s proximal interphalangeal joint (i.e., knuckle) into the boundary between your frontal and parietal skull bones.

It hurt, but it was a tolerable level of pain compared to some other bullying alternatives.

For example, a snuggies attack, the process in which someone reaches into your pants from behind and grabs your Fruit of the Looms (i.e., underwear) and attempts to pull them over your head.

While that attack hurt less than the noogie, it inflicted far more emotional pain, particularly when conducted in front of fellow students.

Luckily, God blessed me with a low center of gravity and exceptional twitch muscle speed that helped me avoid most snuggie attacks.

Noogies, however, were another matter. Once they had your neck in a grip, they owned you. And to fight back it required a different set of fighting skills to weather the demoralizing fury of an unforeseen noogie attack.

And while my younger self was never a master of hand-to-hand combat techniques, occasionally I could resist a noogie strike by using my free, outside arm to land a few solid, but usually ineffective punches at my attacker’s crotch.

Inevitably, the response to such a countermove was for my attacker to grind his knuckle into my skull even harder — to the point where it actually hurt — forcing me to withdraw my crotch-directed response and, instead, utter the internationally-accepted indication of unconditional defeat, “Uncle!”

I bring up these traumatic childhood memories because I believe they are a metaphor for policymaking in the U.S. today.

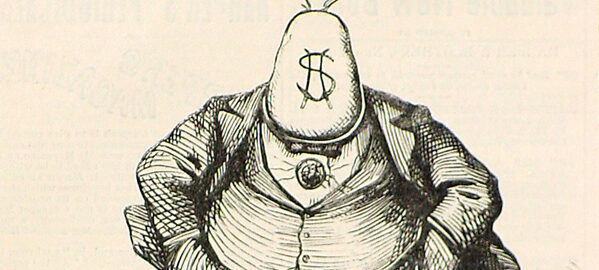

Most Americans live in a perpetual noogie-hold courtesy of corporate America, whether they know it or not. And no piece of national legislation better exemplifies that condition than the Inflation Reduction Act of 2022, recently passed by the U.S. Senate and certain to end up on President Joe Biden’s desk for signature sometime in the near future.

What is wrong with the Inflation Reduction Act of 2022?

The Inflation Reduction Act (IRA) is anything but a public policy designed to reduce inflation. Instead, it is the motherload of bad policy ideas, designed more to help the wealthiest Americans than to impact, in a positive way, the lives of regular Americans.

How do I know? Read the text.

If taming inflationary pressures is the primary bill’s goal, Part 1 of the bill (Corporate Tax Reform 5 Sec. 10101. Corporate Alternative Minimum Tax) is an inauspicious start.

Ostensibly, the bill’s intent to raise government revenues by initiating a 15-percent minimum tax on large corporations could easily be a Bernie Sanders idea. But, in reality, it is not.

Firstly, accelerated depreciation is exempted. That is, compared to straight-line depreciation, this provision allows more depreciation of an asset’s life in its earliest years (and less in later years). In practice, according to corporate tax experts, accelerated depreciation encourages wasteful tax shelters, drains revenue from the U.S. Treasury, is irrelevant to small businesses, and does little to help the economy.

But, more importantly, this provision potentially increases inflationary pressures, not decrease them.

Why? Because if you are a company facing a drain on your bottom line there are two primary options: lowering costs (such as laying off workers) or raising revenues through price increases on the goods and services you offer customers.

Neither is good for the economy.

In other words, corporate America has consumers in a perpetual noogie-hold and raising their costs of doing business through higher taxes (i.e, landing a figurative crotch shot) only backfires in the long run through higher unemployment or higher prices.

OK, so we are off to a bad start with the IRA. How about its other provisions?

Thanks to Arizona Senator Kyrsten Sinema, a Democrat, the IRA no longer includes a provision to close the carried interest tax loophole that benefits private equity and hedge fund managers (a loophole even uber-capitalist Donald Trump opposed). Instead, Sinema allowed a one-percent excise tax on stock buybacks that, in theory, brings in more revenue than eliminating the carried interest tax loophole as it will likely incentivize companies to issue dividends instead, which are taxed when issued.

As to its effect on stock prices or the macroeconomy, Wall Street expects little impact.

Very well, the tax provisions in the IRA are, at best, unlikely positively impact inflationary pressures, and could potentially have the opposite effect.

But fear not, the IRA applies the brakes on the primary cause of inflation — economic growth — by unleashing the Internal Revenue Service (IRS) on tax-paying Americans who are the least equipped to defend themselves from a federal tax audit.

According to the current IRA bill (which still has to go through the U.S House), the number of IRS agents and audits will double. And the target of these additional audits most likely will not be the wealthiest Americans, but instead, average U.S. households.

And if the Democrats achieve their stated aims with the IRA, the increased IRS audits will generate at least $124 billion in increased tax collections over the next 10 years.

In comparison to a $23 trillion dollar annual economy, that may not seem like a growth-crushing number, but it will be to the millions of Americans who find themselves in the crosshairs of an IRA bureaucracy that will become bigger and (dare I say) more powerful than the Pentagon.

Well, at least the IRA has one provision that will most certainly suppress economic growth and, in turn, curb inflationary pressures.

What other damage could the IRA do to this country?

If you are a fan of wealth inequality, the IRA is also likely to direct even more money to the wealthiest Americans through the more than $300 billion earmarked to fund “investments” in attacking climate change and boosting the growth of clean energy. The most visible financial handouts will be to those Americans able to purchase electronic vehicles (EVs) such as bargain-end Tesla’s currently selling for around $50,000, but farmers and ranchers will also get their share of the jackpot through cash incentives for reducing methane emissions (e.g., cow farts).

But that is not the most toxic element of the IRA that will increase wealth equity; instead, the bill will fund the launch of the National Climate Bank which will be tasked to make “investments” in clean energy technologies and energy efficiency — or, as I would put it, an additional bureaucracy authorized to print money that will be immediately transferred to corporate accounts through loans and the federal contract process.

Who will benefit most by this spending? Corporate executives.

Hey, it’s a free market. I don’t fault companies for exploiting the federal government’s ability to print money. However, I do fault the politicians — Democrats and Republicans — that confuse federal spending with actually solving a national problem (e.g., climate change). And, trust me, nobody will be held accountable if in 10 years the U.S. is emitting more greenhouse gases than ever and little has been done to actually address our warming planet.

My prediction is that the IRA’s $300 billion will be pissed away faster than you can say Solyndra.

Even though his companies have received billions in government subsidies — and why would anyone expect him to turn them down? — Tesla CEO Elon Musk has repeatedly said the U.S. government is not a good “steward of capital.”

Is there anything good in the IRA?

Despite the private-equity lobby winning again, the IRA does have provisions that are net positives according some progressive economists.

The most cited provision that will primarily help Americans 65 and older is the one that empowers Medicare to negotiate prices with drug companies. This a policy that has been pursued by progressives for years and now, finally, has a real chance of becoming a reality. Additionally, this potential savings in prescription medicines will help fund a three-year extension of government subsidies supporting the Affordable Care Act (ACA) that would have expired next year.

That is a big deal and should not be diminished.

The Bottom Line on the IRA

Progressives are having a hard time getting excited about the IRA.

Vermont Senator Bernie Sanders tries, but the constipated look on his face when he attempts to defend the bill says more than his measured words:

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Fwww.youtube.com%2Fembed%2FcudBaqbXsQE%3Ffeature%3Doembed&display_name=YouTube&url=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DcudBaqbXsQE&image=https%3A%2F%2Fi.ytimg.com%2Fvi%2FcudBaqbXsQE%2Fhqdefault.jpg&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=youtube

In short, Sanders is saying everything he proposed to make the bill acceptable was rejected by his own party.

If anyone remains deluded that the leaders of the Democratic Party are good for progressive policy ideas, now is the time to end such conceits.

The IRA is a crappy bill, anti-progressive to its core, that will do little to reduce inflation, stop climate change, or lower the national debt; but, instead, could undue the electoral advantage the Democrats gained with the Supreme Court’s overturning Roe v. Wade. Its a bad bill openly designed to help the privileged few whose lobbyists crafted it.

The Democrats, not just progressives, may well regret passing it.

- K.R.K

Send comments to: kroeger98@yahoo.com