By Kent R. Kroeger (Source: NuQum.com; December 5, 2018)

Some American climate change activists and progressive journalists are already trying to portray the French anti-carbon tax protests, also known as the Yellow Vest protests, as something unrelated to the actual carbon tax itself.

Don’t blame French President Emmanuel Macron’s climate change policies for the protests — that is merely a convenient excuse — blame Macron’s own political ineptitude, they say.

“What began as an automobile-focused, cost-of-living protest undertaken by a coalition of the white, rural working-class and petite bourgeoisie has evolved into a Hydra-headed autumn of discontent, with many objectives, no leaders, and a base that encompasses a cross-section of French life from engineers to paramedics to Parisian high school students. International coverage has focused on the movement’s opposition to a proposed fuel tax increase that was part of Macron’s plan to combat climate change,” writes Slate’s Henry Grabar. “But that was only the spark. Spurred by everybody’s favorite anti-governmental social network, Facebook, the gilet jaunes crisis is best understood as a revolt against all things Macron.”

That’s like saying about an arson-lit forest fire, “Don’t blame the arsonist, blame those flammable trees.”

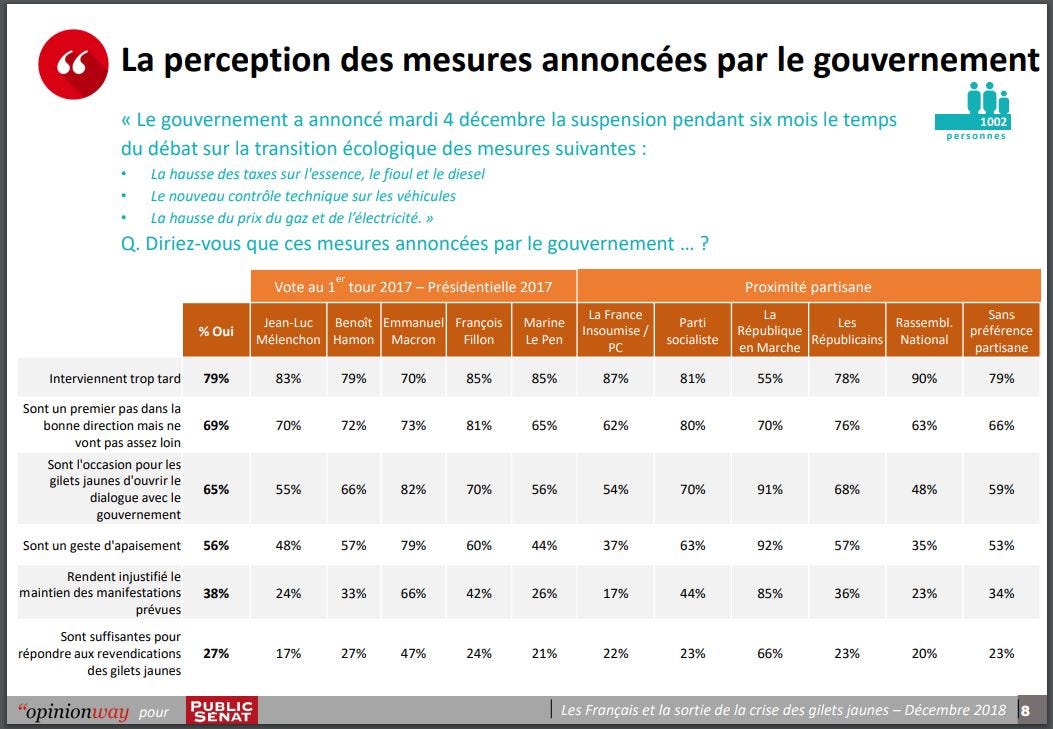

Of course, the Yellow Vest protests are pulling in anti-Macron sentiment across the entire French political spectrum. Recent polling data collected by Opinion Way clearly show how support for the Yellow Vests comes from both of Macron’s flanks.

Only 24 percent of 2017 presidential election supporters of the far-left’s Jean-Luc Mélenchon and 26 percent of the far-right’s Marie Le Pen think the protests should end. Likewise, a minority of socialist Benoît Hamon (33%) and mainstream conservative François Fillon supporters (42%) want to see the protests end.

Figure 1. French public opinion regarding the Yellow Vest protests

But what was Macron’s central campaign theme? It was the fulfillment of the requirements set forth by the 2015 Paris Agreement on Climate Change. Even Hamon, the socialist/environmentalist candidate in the 2017 election, warned French voters that Macron and his Paris literati friends were going to finance France’s climate change policies on the backs of the working-class, while also giving a huge tax break to France’s wealthiest families. Which is exactly what Macron did!

At least in France, politicians do what they promise to do.

So, yes, the Yellow Vest protests are about Macron’s political weakness, but they are also about his unfair tax policies. One causal factor cannot be divorced from the other. The carbon tax increase (which was on top of an existing carbon tax) lit the fire and it is Macron’s record of elite-friendly policies that keep the flames hot.

And what has our warming planet gained from France’s progressive carbon tax policies? Carbon dioxide emissions grew in France by 1.8 percent in 2016 and by 2.0 percent in 2017.

And don’t forget Macron just announced the closing of 17 more nuclear plants by 2025 which are almost CO2 emission-free. Why? Because nuclear plants are economically less viable given the technical expertise in building new ones or upgrading them has shifted away from France, U.S. and Europe to countries like China, India, South Korea, United Arab Emirates, Pakistan, Turkey, Bangladesh, Argentina, Brazil, and Japan, according to the World Nuclear Association.

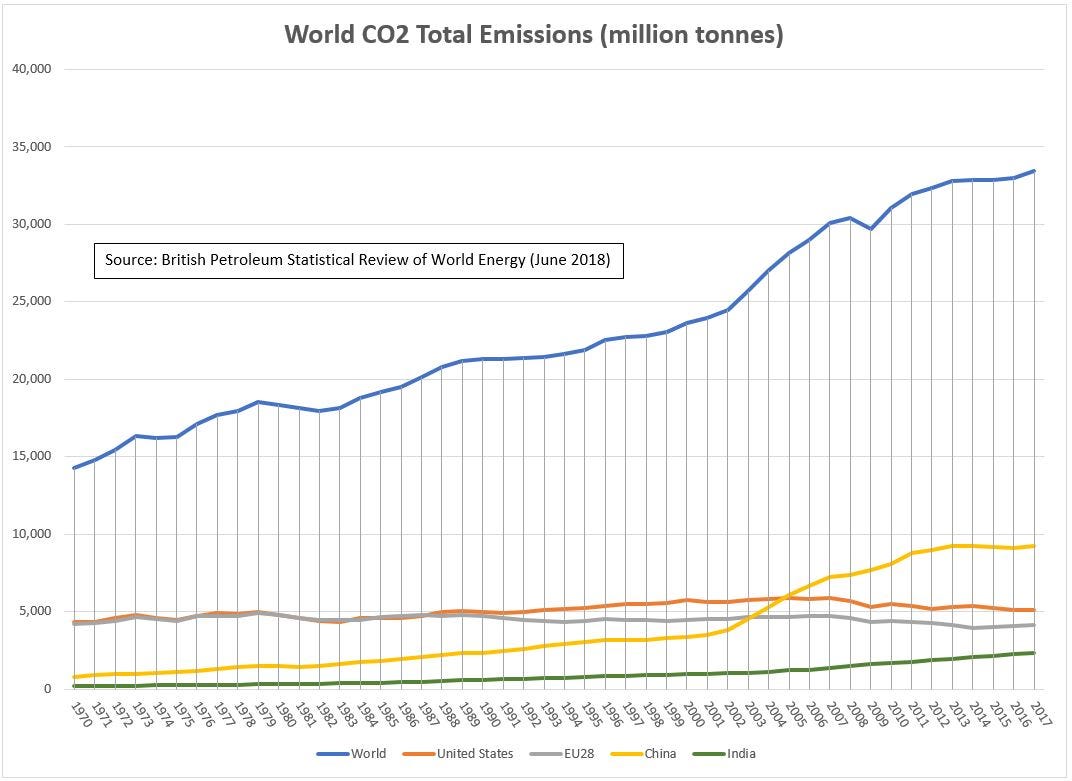

And what about in the U.S. where climate change activists insist not nearly enough is being done to combat climate change? Carbon dioxide emissions fell in the U.S. by 1.6 percent in 2016 and by 0.5 percent in 2017. In recent years, the U.S. has been outperforming the world, including Europe, on reducing carbon dioxide emissions (see Figure 2 below).

Figure 2. World CO2 total emissions

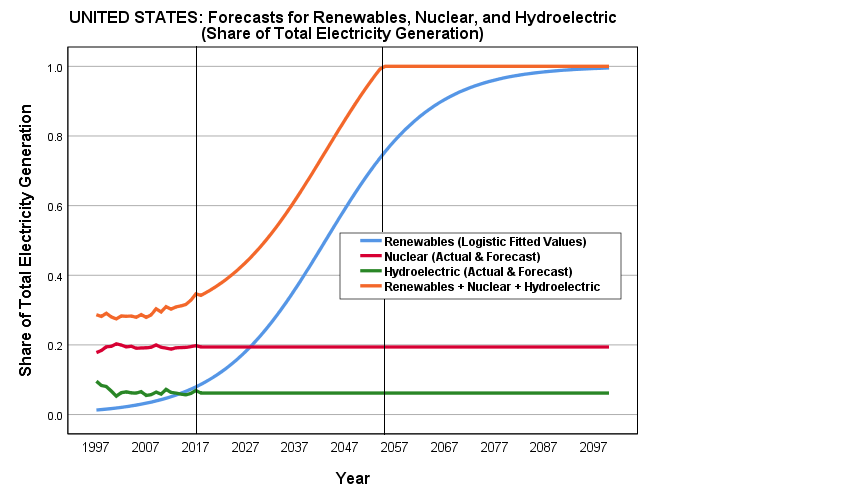

Why is the U.S. performing better than France and most of the world on reducing carbon dioxide emissions? The increased extraction of domestic natural gas, the secular decline of coal and the early stage rise of renewables is putting the U.S. on a solid path to be near-100 percent renewable energy by 2055, according to my forecasts generated using data from the U.S. Energy Information Agency (EIA) and the International Energy Agency (IEA) (see Figure 3 below).

Figure 3. Renewable energy forecast for U.S. (2018–2100)

The New York Times has also used its objective reporting to subtly question the authenticity of the French carbon tax grievances.

“While polls show that the Yellow Vests have the backing of three-quarters of the population, questions have swirled about how much pain the protesters are really experiencing — or how much of the outpouring can be chalked up to a centuries-old culture of demonstrating against change,” writes Times staff writer Liz Alderman. “France protects citizens with one of the most generous social safety nets in the world, with over one-third of its economic output spent on welfare protection, more than any other country in Europe. To get that help, French workers pay some of the highest taxes in Europe.”

In other words, according to Alderman, the French are just cranky people who at the drop of a hat will pour their garbage into the streets so they can impede traffic.

First, I need to stop being annoyed when well-paid journalists at prestigious news organizations use lazy rhetorical devices such as “…questions have swirled…” in order to insert their personal biases and opinions into what should be objective journalism. Sadly, that pig left the pen many years ago and there is no point in trying to get him back.

Second, if the climate change activist community — which apparently includes the Times staff — is trying to convince itself that France’s yellow vest protest is the manifestation of a deep-seeded cultural norm against change instead of a genuine economic protest against higher taxes, they will get a real education should a similar carbon tax be introduced in the U.S. after the 2020 elections.

Lessons climate change activists need to learn

First Lesson

If the Yellow Vest protests offer any insight, it is that the financial burden of addressing climate change cannot disproportionately fall on lower- and middle-income households.

Even if one believes the Yellow Vests are merely right-wing populists using the carbon tax increases to exploit the unpopularity of the Macron government (though, as shown above, a majority of leftists in France also oppose Macron’s regressive carbon tax policies), they potentially represent 30 to 40 percent of the French population — more than enough to drive re-election obsessed politicians into a fetal position under their desks.

The 49 newly-elected U.S. House Democrats that won in tightly contested battleground districts may be more resistant to carbon tax increases than climate change activists may want to accept.

If the U.S. House tries to pass even a meager 35 cent per gallon tax on gasoline — an increase close to the Obama administration’s 2015 estimate of what is necessary to offset the damage to the environment caused by each incremental ton of CO 2 emission — resistance will be fierce, even among some Democrats.

But that doesn’t mean it shouldn’t be considered. And recall that Trump suggested a 25 cent per gallon tax increase to pay for transportation infrastructure improvements. So, it is possible that an additional gasoline tax (or some form of carbon tax) could pass the Congress in the next session and receive the president’s signature, particularly if sold on the premise of fixing our roads and bridges.

But climate change is probably a more costly beast and an additional 25 cents a gallon is grossly insufficient, according to the Intergovernmental Panel on Climate Change (IPCC) report issued this fall, which suggests a gasoline tax increase measured in hundreds of dollars may be necessary.

Nothing on that scale will ever happen (World War II would break out if it did). However, for many good reasons — such as climate change, pollution, and ending the disproportionate influence of brutal Middle East dictatorships — the world needs to end its dominate use of fossil fuels to power economic growth.

In that effort, economists tell us the best way to stop an unwanted type of economic activity — such as burning fossil fuel — is to tax it directly. William D. Nordhaus, this year’s co-winner of the Nobel Prize in economic science, describes carbon taxes as “the most efficient remedy for the problems caused by greenhouse-gas emissions.”

The overwhelming majority of climate scientists agree that addressing climate change will require a fundamental transformation of the world’s energy economy. Fossil fuels must be phased out as quickly as possible and zero-carbon-emissions achieved by 2050, according to the 2015 Paris Agreement’s communique; and to do so, carbon taxes (or variants such as cap-and-trade) are going to become a common policy tool for governments to achieve the Paris goals.

There many carbon tax variants. Some target businesses. Others target households. Some disproportionately hurt lower income households. Others shift the burden to wealthier households.

Recent research by Columbia University says, if and when some form of carbon tax is passed in the U.S., choose it wisely.

In a 2018 study by Columbia University’s Center on Global Energy Policy, researchers Joseph Rosenberg, Eric Toder, and Chenxi Lu determined that, in most scenarios, a carbon tax in the U.S. would disproportionately burden lower- and working-class Americans.

“A federal carbon tax in the United States would reduce greenhouse gas emissions and generate significant new revenue for the federal government,” conclude the study’s authors.

Depending on how its revenues are used, such a tax would potentially burden lower-income households more than higher-income households. For example, when the revenue is used to reduce the deficit or reduce the corporate income tax (as Republicans would likely insist), a carbon tax is regressive. However, using the revenue to provide lump-sum rebates would more than offset the carbon tax burden for low- and middle-income taxpayers while leaving high-income families with a net tax increase. The carbon tax revenues could also be used to reduce employee payroll taxes, resulting in “a net benefit for upper middle-income taxpayers, while increasing tax burdens modestly for low-income and the highest-income households.”

Adele Morris of The Brookings Institution and Aparna Mathur of the American Enterprise Institute developed a carbon tax model that attempted to balance the need for behavior modification (reduce fossil fuel use), deficit reduction (pay down the national debt to free up financial resources for when the costs of climate change become more explicit) and fairness (minimize the tax’s impact on lower-income households).

In their proposal, the carbon tax would start at $16 per ton of CO2 and increase with inflation plus four percent each year. According to their estimates, such a tax would reduce emissions in the U.S. by 9.3 billion tons and raise $2.7 trillion in new revenues over the next 20 years. To meet the three goals of behavior modification, deficit reduction, and tax fairness, their proposal calls for distributing the revenues across three channels: (1)

They’d split the money three ways: (1) Use $800 billion to reduce the national debt (a drop in the bucket, but a step in the right direction), (2) cut corporate taxes (the Morris and Mathur proposal predates the Trump tax cuts), and (3) and offer tax rebates to low-income households to partially offset the tax’s impact on their family budgets.

That may be the minimum cost for weening ourselves from fossil fuels. But smart policy and good intentions are not enough to completely mitigate the financial stress such tax increases may have on some households. A no democratically-elected government can ignore the electoral implications of significantly higher carbon taxes. Trying to call it something other than a tax (which was tried in selling Obamacare to the American people) is dishonest and will only feed an already historic level of distrust directed towards our elected leaders.

If Macron falls, you can be certain democratic governments across the globe will think twice about creating new carbon taxes or raising existing ones. At the very least, they will need to balance taxation equities with the potential effectiveness of such carbon taxes.

Second Lesson

Technological advances are not achieved through good intentions or by simply throwing money at the problem. Breakthroughs require an unknown amount of time — sometimes they happen faster than expected and sometimes they don’t. I am still waiting for nuclear fusion to finally come around.

That is why pushing too fast on the expansion of renewable energy before certain technical advancements are made will add needless costs to energy consumers.

Ask any German.

Germany’s Energiewende, or “energy transition,” has led to record breaking high electricity prices in Germany that are among the highest in the world, in part because the Germans were too aggressive in building out renewable energy capacity. Since renewable energy sources like wind and solar are intermittent (there are a lot of cloudy, windless days in Germany), the potential for grid failures is not negligible.

“Energiewende has required that Germany build more coal fired electricity plants; 10 gigawatts worth in the last several years,” writes Utah State University professor Randy Simmons and Josh Smith, a research manager at the Center for Growth and Opportunity at Utah State University. “In sum, despite Germany’s expensive and exuberant renewable energy support, they aren’t even achieving their supposed goal of lowering carbon emissions. This is true even though renewables make up about 40 percent of Germany’s total electricity supply.”

Apparently, even Germans are not immune to idiot-groupthink (where the dumbest ideas rise fastest). In their tunnel-vision approach to policymaking, exhorted by environmental lobbyists that show no sensitivity to how rising energy prices hurt society’s most vulnerable, the Germans have hurt their lowest-income households while also under-performing the U.S. in reducing CO2 emissions in the past few years.

“The regressive effects of energy policy and the ways that well-intentioned environmental policies have actually contributed to energy poverty, meaning it made it harder for the poor to heat and power their homes, is an underappreciated area of debates around the transition from fossil fuels to alternative energy sources,” writes Simmons and Smith. “Policymakers around the world ignore it at the peril of “greening” the economy on the backs of the poor.”

This is not right wing propaganda and that is why good intentions are not a substitute for smart policymaking.

Therefore, significant technological advancements — particularly in battery storage capabilities and carbon capture — must be made soon in order for the conversion to renewable energy not cripple the world economy.

Today, industrial-level batteries can store energy for 2 to 8 hours, but we will need that storage life-expectancy to exceed 2 to 8 months if renewables are to overcome their intermittency problem. Countries and cities moving too fast now in becoming ‘100-percent renewable’ are forced to duplicate electricity generating capacity using reliable sources (natural gas, nuclear) to compensate for daily and seasonal variation in renewable energy generation. That is making electricity twice as expensive in countries like Germany which has moved very fast in converting to renewable energy, and California is facing the same problem.

Another technology critical for there to be any chance to meet the IPCC and Paris Agreement global warming and emission goals is carbon capture and sequestration (also known as CCS). As the planet is likely to push past 2050 and still be using fossil fuels for at least transportation purposes, it will be important for technologies to exist that can draw CO2 out of the atmosphere and to capture it at the energy generation level (e.g., tailpipes and smoke stakes).

In an August 2018 Congressional Research Service report, Peter Folger, an expert in energy and natural resources policy, details recent advancements in CCS and the amount of federal research monies going into the research. But despite some positive developments, he concludes: “There is broad agreement that costs for CCS would need to decrease before the technologies could be deployed commercially across the nation.”

Therefore, for these technological breakthroughs in battery storage and CCS to occur, more research will be needed and that will cost money. Most of that money should come from the private sector, but some will nonetheless come from the public sector and will probably be raised through additional taxation — possible increased carbon taxes.

Third Lesson

If the U.S. never increases carbon taxes in any substantial way, you can thank Barack Obama.

That is not a criticism. Quite the opposite, the Obama administration showed countries how they can fundamentally alter their energy profile trajectories without directly raising taxes.

To address climate change, the Obama administration circumvented legislative pathways and implemented a substantive array of energy policies using existing law. The result?

Largely through regulatory changes (which typically raise costs to businesses that are then passed on to consumers), the Obama administration effectively killed the coal industry by imposing on it a comparative economic disadvantage to renewables and natural gas.

More importantly, there is nothing the Trump administration can do to bring coal back. Despite last week’s decision by the Trump EPA to relax emission standards for new coal plants, the trends are irreversible.

The policy change would have been significant if U.S. energy companies were still building coal plants or significantly extending the life of existing ones. But there are no new U.S. coal plants in the construction pipeline. A small research coal plant in Alaska is still scheduled for construction, but inconsequential in the broader scheme of things.

And what about the rise of clean coal? Like the monster Grendel in Beowulf, its more myth than reality.

What the Obama did to cut the coal industry off at the knees is important to repeat: They killed the coal industry without directly raising taxes on consumers.

Therefore, the third lesson for climate change activists is to challenge the presumption that higher taxes are necessary to effectuate meaningful climate change policies. But if taxes are raised, don’t let the government gets its grubby hands on the proceeds.

That is not the same as saying households can avoid making financial or lifestyle sacrifices to address climate change. It is saying that sending $50 to $150 trillion — the IPCC’s cost range estimate required to limit global warming to 1.5°C over pre-industrial levels — through government bureaucracies does not sound like a good answer to any problem. Global warming will be limited far faster by private sector investments and ingenuity than expecting Nancy Pelosi to know how to spend it.

Nobody has forgotten how solar cell manufacturer Solyndra received a $535 million U.S. Energy Department loan guarantee as part of the Obama administration’s 2009 economic stimulus program. A loan that left the U.S. taxpayer with a $528 million loss entry on the balance sheet.

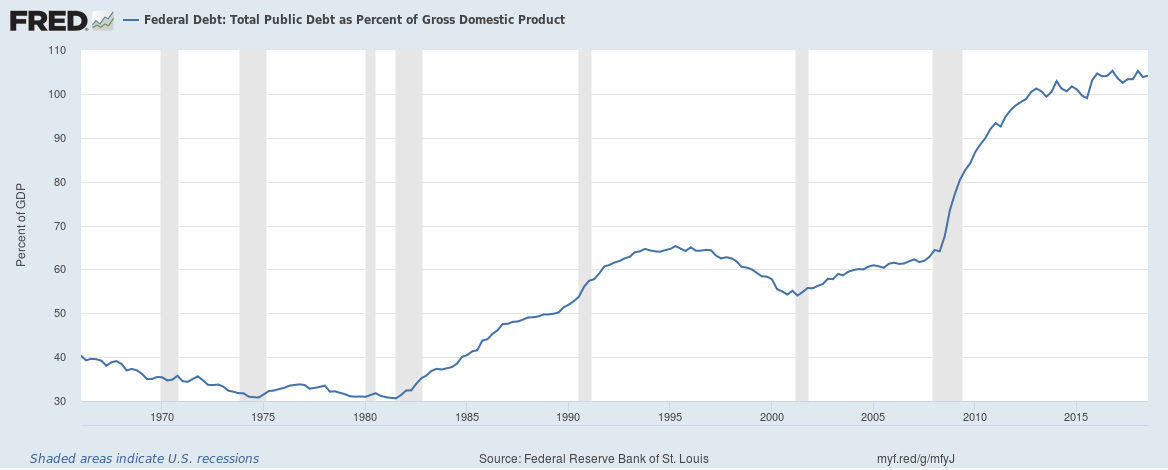

Most notable about the Morris and Mathur proposal summarized previously is that it does not put the additional revenues from the carbon tax in the hands of the government. Their proposal does the smartest thing you can do with such revenues: pay down the national debt. When the bulk of the costs associated with climate change materialize, the U.S. will be in a better position to address those costs if our total public debt as a percent of GDP is not still over 100 percent.

Figure 4. Total U.S. public debt as percent of GDP

Alas, history makes me pessimistic that the real problem of climate change will inspire Washington, D.C. politicians to suddenly find Jesus when it comes fiscal responsibility.

Instead, expect the U.S. government to solve the climate change problem the same way it is solving the problems of the Afghan people. Throw U.S. treasure at it while padding the bank accounts of those most tightly knit with the political leadership in Washington, D.C. That is how the system works and there is no reason to think now, suddenly, establishment Democrats and Republicans have figured out how to do things the right way.

Fourth Lesson

The fourth lesson builds upon the third: Free market capitalism, warts and all, is the most powerful force we have to combat climate change. The private sector, from the corporate boardroom down to the household level, is where the real progress on climate change will be made…and is being made.

Free market capitalism adapts and profits from change not because it consciously organizes itself to do so, but because it can’t help itself. Every crisis. Every challenge. Every unexpected change to the system activates an entrepreneurial class always in search of the next profit opportunity.

That is what drives the world economy and what foretells that humans will overcome and prosper from whatever obstacles are generated by the current anthropogenic warming of the planet. Free market capitalism, particularly when unburdened from the market distortions generated by a too-powerful oligarchical class, works in the aggregate.

What is free market capitalism’s wheelhouse, after all? Destroying perfectly good crap and replacing it with even more crap. And what is the essential risk from climate change? Its potential to destroy life and property.

We have recent experience to demonstrate this.

Hurricanes Harvey and Irma hit the Texas and Florida coasts, respectively, in Fall 2017. The flooding from Harvey was historic as it stalled over Houston and the damage by Irma was reminiscent of Hurricane Andrew, a Category 5 hurricane (one of only three to ever hit the U.S.) that hit south of Miami in 1992.

This is a preview of climate change’s grave threat to our way of life, declaredThe New York Times.

Well, that may be. But if the economic growth is one of our prosperity measures, the argument that the U.S. is not prepared to withstand the hazards of climate change is too simplistic.

As Figure 5 shows, Hurricanes Harvey and Irma did not irreparably harm the Texas or Florida economies. Real GDP growth was at the national average of 3.0 percent in both states during the quarter in which the hurricanes hit. In the subsequent quarter, real GDP growth in Texas fell below the national average (1.2 percent versus 2.4 percent, respectively), but in Florida the economy was stronger in the third quarter of 2017 (3.8 percent growth). By the second quarter in 2018, both states were growing faster than the national average, and in the case of Texas, their economy is booming. Of course, energy prices, defense spending and other factors are playing major roles in the economic health of these two states. Still, the experience from Harvey and Irma reinforces the fact that the U.S. economy is too large, dynamic and diverse to presume it is ill-prepared to handle climate change’s enormous challenges.

Figure 5. Percent change in real GDP for Florida, Texas and U.S. (2017 Q2–2018 Q2)

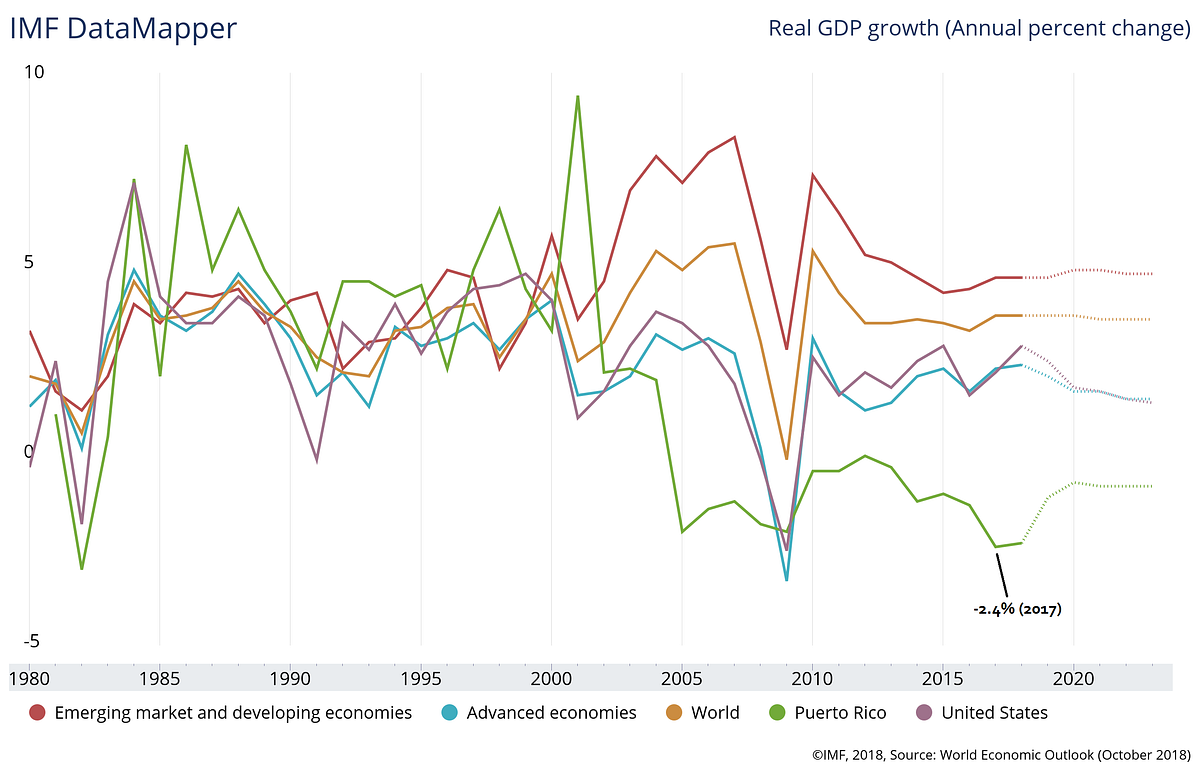

What about Puerto Rico? Unfortunately, the aftermath of 2017’s Hurricane Maria does not leave us optimistic. However, to assign blame for Puerto Rico’s economic struggles to climate change is short-sighted.

Figure 6 shows Puerto Rico’s real GDP growth relative to the U.S. and the world. Since 2005, prior to Hurricane Maria, Puerto Rico’s real GDP growth had been negative, averaging around -1.0 percent annually. In 2017, her growth rate fell over 1 percent to -2.4 percent, in large measure due to the consequences of Maria. But the short-term economic growth trend in Puerto Rico (from 2012 to 2016) was already bleak before Maria ever hit. High public debt and a stagnant job environment was already leading many Puerto Ricans to leave the island for the mainland. That was not Maria’s fault and, in fact, the near term growth forecast is looking more positive, though well below positive growth.

Figure 6. Real GDP growth, actual and forecast (1980–2025)

If there is a lesson from the 2017 hurricane season it is that impoverished communities are most at risk from storms, and as climate change increases the intensity of such storms, it is these communities that will suffer the most.

In truth, the biggest threat from climate change may be its exacerbation of wealth inequality more than its threat to human lives or economic prosperity.

And, yet, we have Democrats like former Hillary Clinton adviser Neera Tanden scolding those who bemoan the regressive nature of carbon taxes and their negative effects on low- and middle-income households.

If that is not textbook establishment Democrat thinking, I don’t know what is. An absolute inability to empathize with others from a different social class or educational background. But if they ever need to exploit the struggles of the poor and working-class for political gain, they push to the front of the line with bells on.

It’s public service as nothing more than posturing and virtue signaling. If you need to demean rank-and-file members of your own party that have a different opinion, feel free. It’s not like they are big money donors or anything. And don’t forget to check your poll numbers before you make a nebulous policy statement that commits yourself to nothing.

This is why newly-elected House members Alexandria Ocasio-Cortez (D-NY) and Rashida Tlaib (D-MI) are so revolutionary and poised to make genuine change happen in Washington. Despite disagreeing with them both on many issues, I don’t question their motives or sincerity.

That’s a big deal and why they will become powerful counterweights to their party’s corrupt leadership.

But, in the meantime, who can be blamed for not trusting our elected leaders to take $2 to $4 trillion from taxpayers in the next 20 years so they can play ‘climate doctor’ with the money. We know in our hearts the U.S. Congress won’t solve the problem.

There was a time when the U.S. Congress was good at solving large social problems or tackling big challenges. Social Security successfully addressed extreme poverty among our disabled and elderly. The Apollo moon program, funded on the public dime, achieved President John F. Kennedy’s stretch goal of getting to the moon by the end of the decade.

And don’t forget we defeated the Nazis and the Japanese in just three years.

Today, the Congress is little more than a clown school for wealthy lawyers. They don’t solve problems, they perpetuate them and enrich their friends while doing so. Climate change activists, therefore, would be smart to disembark the clown car as soon as possible.

Fifth (and final) Lesson

The fifth lesson is the simplest (and hardest) of all to master: Live your values.

If someone really believes the quality of life for humans on earth is threatened by climate change, wouldn’t they change their personal energy consumption habits, even if their sole effort would not register on a global scale? Wouldn’t that person still want to be a role model for others in the hope that individual-level efforts may aggregate up to important improvements on a higher scale?

Yet, so many of our politicians and opinion leaders advocating for immediate action on climate change show no evidence that they are themselves willing to sacrifice personal luxury or lifestyle to ‘save the planet.’

From Joe Blow’s perspective, climate change activists are just another group of social elites trying to secure their share of the American largess. For every Prius in the parking lot at the Unitarian Church of Hopewell Valley (NJ), there are two BMWs or Volvos with ‘Save the Planet, Vote Democrat’ bumper stickers. That is virtue signaling in its most cynical form.

Overwhelming public demand for higher gas taxes is not going to be the result of a coordinated, nationwide grassroots effort. Not unless at least one fundamental change occurs within the advocacy community.

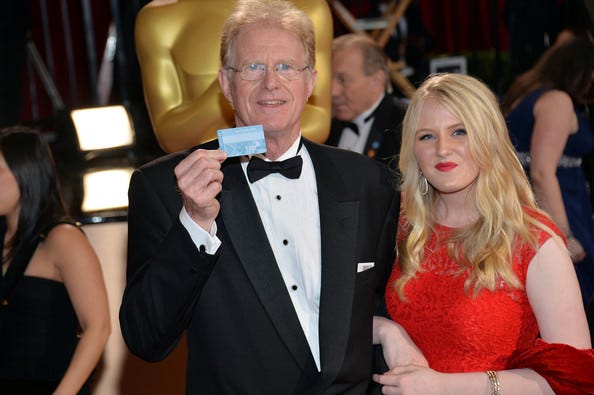

To have broad credibility, environmentalists must pass what I call the Ed Begley Jr. Test.

The 69-year-old actor is known to many for his role as Dr. Victor Ehrlich on the television series St. Elsewhere (1982–1988). However, since then, he may have become better known for his environmental activism.

He bought his first electric vehicle, a Taylor-Dunn golf cart, in the early 1970s, a time when ‘global cooling’ was seriously discussed within climate science circles.

Begley’s home covers a modest 1,585 square feet and relies on solar power, wind power (via a PacWind vertical-axis wind turbine), and an electricity-generating bicycle (used to toast bread). His annual electricity bill runs around $300. A long time critic of suburban lawns, Begley eschews grass and instead covers his yard with drought-tolerant plants.

In other words, he lives his values.

So, when he talks about climate change, I take him seriously. He’s earned that respect. And while I have no doubt there are clandestine photos of Begley Jr. jumping out of a gasoline-powered limousine, he’s more than established his authenticity on environmental issues.

It would be nice if other Hollywood activists and national politicians showed the same congruence between their words and lifestyle.

When a 2016 analysis of U.S. Senate office spending accounts revealed that Senators Charles Schumer and Kristen Gillibrand spent a combined $442,000 in public money flying private airplanes between October 2014 and September 2015, the story barely made a ripple in the mainstream media.

Every time Leonardo DiCaprio flies his buddies to the Maldives or yachts around the Mediterranean with super models, he’s really telling us: “Piss on you. Do as I say, not as I do.” I don’t believe for one second DiCaprio or George Clooney or Nancy Pelosi or Rachel Maddow believe human civilization as we know it is threatened by climate change. If they truly believed, they would lead by example.

But they don’t.

By not living the values they preach, it is reasonable to assume their advocacy for ‘a fundamental transformation of the energy economy’ is really just a shakedown of the American people to finance the neoliberal hegemon. Climate change scaremongering appears to many Americans as merely a partisan money grab.

The recently released documentary film, “The Panama Papers,” about how the world’s economic elites are hoarding their wealth in off-shore accounts to avoid domestic taxes, only reinforces a belief by many that politicians advocating higher taxes to pay for climate change policies don’t intend to subject their own fortunes to the financing of the world’s energy transformation. That is common hypocrisy.

The Yellow Vest protesters in France may be predominately white and less educated and their grievances may go far deeper than just dissatisfaction over a regressive carbon tax. But to therefore ignore the relevancy to the U.S. of their anti-carbon tax message is a potentially grave mistake for those that want to see the U.S. do more than it already is on combating climate change.

- K.R.K.